Irs Fsa Contribution Limits 2025 - 401k Contribution Limits 2025 After Tax Janela Kaylyn, The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure. Employees can now contribute $150. IRS increases FSA contribution limits in 2025; See how much, But in 2025, the 401 (k) contribution limit increases to $23,000. In tax year 2023, employees were limited to a maximum contribution of $22,500.

401k Contribution Limits 2025 After Tax Janela Kaylyn, The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure. Employees can now contribute $150.

401k 2025 Contribution Limit Chart, The irs recently announced that flexible spending account contribution limits are increasing. Here are the new 2025 limits compared to 2023:

Irs Dependent Care Fsa Limits 2025 Nissa Leland, If the fsa plan allows unused fsa. There are no changes to dependent.

2025 Charitable Contribution Limits Darcy Melodie, In 2025, employees can contribute up to $3,200 to a health fsa. The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

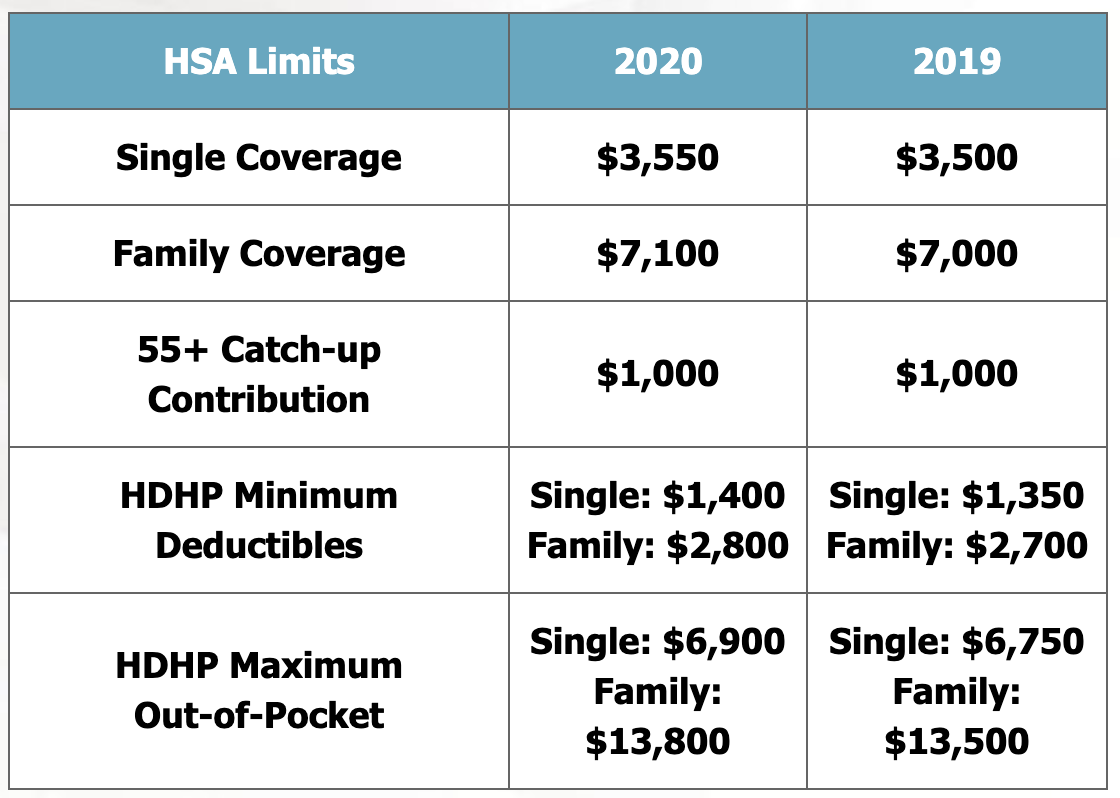

Significant contribution increases will allow employees to save more with their hsas next year.

IRS Raises 2025 Employee FSA Contribution Limit to 3,200 NTD, On november 10, via rev. Significant contribution increases will allow employees to save more with their hsas next year.

Irs Fsa Contribution Limits 2025. In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050). If you don’t use all your fsa funds by the end of the plan.

Your employer may set a limit lower than that set by the irs.

2025 Contribution Limits For IRA, 401(k), HSA, FSA, 403(b), 457(b, The 2025 fsa contribution limit for health care and limited purpose accounts is $3,200. But in 2025, the 401 (k) contribution limit increases to $23,000.

Irs Fsa Max 2025 Joan Ronica, Significant contribution increases will allow employees to save more with their hsas next year. On november 9, 2023, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.

In 2025, the fsa contribution limit is $3,200, or roughly $266 a month. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, The fsa maximum contribution is the maximum amount of employee salary. 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200.